[코인] MACD와 RSI 유사성에 기반한 Bitcoin 잠재 ABC 웨이브 / Bitcoin Potential ABC wav…

코인개미

0

2827

2021.09.30 09:55

코인개미

0

2827

2021.09.30 09:55

BraveNewCoin Liquid Index for Bitcoin

This_Guhy

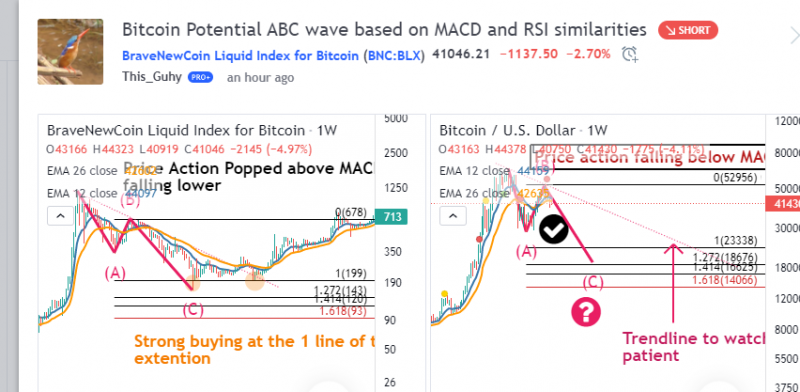

It has become apparent that bitcoin is setting a lower high. With a move as impulsive as bitcoin experienced it is natural to look for an ABC correction after such a move. There are many ways that the price action and charts could develop but the ABC correction is one of the simplest and most fundamental moves that can exist in any analysts tool box and the nice thing is target setting isn't all that difficult. The hard part is sticking to the plan when the emotions start to get high.

The Analysis

The charts have a lot of similarities. First would be a high that was reached impulsively and then enough sideways and down action to create a MACD-Singal cross and the MACD going below zero. That happened in the 2014 bear market and we can see it has happened again. The B wave created a bullish MACD-Signal line cross that has not been sustained and when the MACD crossed the signal line again it was about 23 weeks from the cross to the low at $164 (not shown). The current price action has created the same bearish MACD-Signal line cross and this prospective (for now) B wave created a bullish MACD-Signal cross that has not been sustained. We are part way through the week but if the pattern holds the MACD will continue downward with price action and the MACD will go zero before it crosses bullish again.

Not only has my prospective B-wave created the similar structure on the MACD but it has done the same with the MACD-EMAs. I like to visualize the MACD-EMAs for such a purpose. MACD crosses can have a lot more detail added when you also compare the crosses to what is happening with the EMAs. This price action popping above and then below is very telling, and hopeful for traders, predictive. If this pattern holds we won't see the MACD EMAs crossed bullishly until after the new low is in.

The price saw strong wicking below the 1 line of the fib extension on the first touch and the second touch saw price action only go below the 1 line by a dollar. That second touch also occurred as price action got above the resistance trendline created by the tops of the ATH and the B wave. At this point time will tell which fib extension level would be reached if we are truly in an ABC correction. No matter what of I am broadly correct the extension levels remain the same, what does change are the buy areas for more dynamic trading systems would suggest. So far the two big boys for calling the lows on BTCUSD have been the 200w SMA and the bottom of the monthly Keltner channel. Historically those have both done a great job of calling the lows on a monthly basis and may continue to do so from here on out. Right now the gap between the 200w and the bottom of the Keltner channel is pretty wide but if we continue sideways for a while they should meet up again.

The RSI for now is just to be watched. It helped find the low in 2014 when it approached 30 on the weekly.

Trades

The first technical trade under this assumption is to short the C leg down. There are various entry strategies but a simple one has us looking at the weekly Heiken Ashi chart. The two red candles with no top wicks suggest that the momentum is picking up to the downside and it is unlikely that any rally will go beyond the high around 53k. Shorting daily strength or looking for bearish structures for entries would be advisable, if I was qualified to give advice which I am not (lol). And you guys on your phones are gonna squint at the next chart.

The next trade after that would be long entries. The strong handed accumulators would be buying around the low of the monthly keltner or the 200w as they had before. More cautious traders would be looking for price action to close weekly candles above the trendline from ATH to the top of the B wave. That is a ways off. This is long term planning and so this idea is not for day traders or perhaps most swing traders. I hope to be able to accumulate for a year or more before this starts to move again.

The Analysis

The charts have a lot of similarities. First would be a high that was reached impulsively and then enough sideways and down action to create a MACD-Singal cross and the MACD going below zero. That happened in the 2014 bear market and we can see it has happened again. The B wave created a bullish MACD-Signal line cross that has not been sustained and when the MACD crossed the signal line again it was about 23 weeks from the cross to the low at $164 (not shown). The current price action has created the same bearish MACD-Signal line cross and this prospective (for now) B wave created a bullish MACD-Signal cross that has not been sustained. We are part way through the week but if the pattern holds the MACD will continue downward with price action and the MACD will go zero before it crosses bullish again.

Not only has my prospective B-wave created the similar structure on the MACD but it has done the same with the MACD-EMAs. I like to visualize the MACD-EMAs for such a purpose. MACD crosses can have a lot more detail added when you also compare the crosses to what is happening with the EMAs. This price action popping above and then below is very telling, and hopeful for traders, predictive. If this pattern holds we won't see the MACD EMAs crossed bullishly until after the new low is in.

The price saw strong wicking below the 1 line of the fib extension on the first touch and the second touch saw price action only go below the 1 line by a dollar. That second touch also occurred as price action got above the resistance trendline created by the tops of the ATH and the B wave. At this point time will tell which fib extension level would be reached if we are truly in an ABC correction. No matter what of I am broadly correct the extension levels remain the same, what does change are the buy areas for more dynamic trading systems would suggest. So far the two big boys for calling the lows on BTCUSD have been the 200w SMA and the bottom of the monthly Keltner channel. Historically those have both done a great job of calling the lows on a monthly basis and may continue to do so from here on out. Right now the gap between the 200w and the bottom of the Keltner channel is pretty wide but if we continue sideways for a while they should meet up again.

The RSI for now is just to be watched. It helped find the low in 2014 when it approached 30 on the weekly.

Trades

The first technical trade under this assumption is to short the C leg down. There are various entry strategies but a simple one has us looking at the weekly Heiken Ashi chart. The two red candles with no top wicks suggest that the momentum is picking up to the downside and it is unlikely that any rally will go beyond the high around 53k. Shorting daily strength or looking for bearish structures for entries would be advisable, if I was qualified to give advice which I am not (lol). And you guys on your phones are gonna squint at the next chart.

The next trade after that would be long entries. The strong handed accumulators would be buying around the low of the monthly keltner or the 200w as they had before. More cautious traders would be looking for price action to close weekly candles above the trendline from ATH to the top of the B wave. That is a ways off. This is long term planning and so this idea is not for day traders or perhaps most swing traders. I hope to be able to accumulate for a year or more before this starts to move again.

번역:

BraveNewCoin Liquid Index for Bitcoin

This_Guhy

비트코인이 최저가를 기록하고 있다는 것이 명백해졌다. 비트코인이 경험한 것만큼 충동적인 움직임과 함께, 그러한 움직임 후에 ABC 수정안을 찾는 것은 당연하다. 가격 조치와 차트가 발전할 수 있는 많은 방법이 있지만 ABC 수정은 분석 도구 상자에 존재할 수 있는 가장 간단하고 가장 근본적인 움직임 중 하나이며, 좋은 점은 목표 설정이 그리 어렵지 않다는 것입니다. 어려운 부분은 감정이 고조되기 시작할 때 계획을 고수하는 것이다.

분석

그 차트들은 비슷한 점이 많다. 첫 번째는 충동적으로 높은 수준에 도달한 다음 MACD-싱갈 크로스를 만들고 MACD가 0 아래로 내려갈 수 있는 충분한 횡방향 및 하향 동작입니다. 그것은 2014년 약세장에서 일어났고 우리는 그것이 다시 일어났음을 알 수 있다. B파는 강세 MACD-Signal 라인 크로스를 만들어 냈는데, MACD가 다시 신호선을 넘었을 때는 크로스에서 164달러(표시되지 않음)로 약 23주였다. 현재의 가격 조치는 같은 약세 MACD-Signal 라인 크로스를 만들었고 이 예상 B 웨이브는 지속되지 않은 강세 MACD-Signal 크로스를 만들었다. 우리는 이번 주 내내 일정 부분 진행 중이지만 패턴이 유지된다면 MACD는 가격 하락을 계속할 것이고 MACD는 다시 강세장을 넘기기 전에 0으로 떨어질 것이다.

저의 장래희망 B-wave는 MACD에 유사한 구조를 만들었을 뿐만 아니라 MACD-EMA에도 동일한 구조를 만들었습니다. 나는 그러한 목적을 위해 MACD-EMA를 시각화하는 것을 좋아한다. MACD 크로스를 EMA에서 발생하는 작업과 비교할 때 훨씬 더 자세한 내용을 추가할 수 있습니다. 이 가격 상승은 상기와 하기의 무역업자들에게 매우 시사적이고 희망적이다. 이 패턴이 지속된다면 우리는 MACD EMA가 강세로 교차하는 것을 새로운 최저치가 나올 때까지 볼 수 없을 것이다.

가격은 첫 번째 터치에서 섬유 확장의 1 라인 아래로 강한 위킹을 보였고 두 번째 터치에서는 가격 작용이 1 라인 아래로 1 달러 아래로만 내려갔다. 두 번째 터치 또한 가격 조치가 ATH와 B 웨이브의 정상에 의해 만들어진 저항 트렌드라인을 넘어서면서 일어났다. 이 시점에서 우리가 정말로 ABC 수정에 있는 경우 어떤 섬유 확장 수준에 도달할지 알 수 있습니다. 내가 어느 쪽이든 대체로 옳다 하더라도 확장 수준은 그대로 유지된다 하더라도, 더 역동적인 거래 시스템을 위한 매수 영역은 무엇을 시사하는가 하는 것이다. 지금까지 BTCUSD에서 최저치를 기록한 두 명의 거물은 200w SMA와 월간 Keltner 채널의 최하위였다. 역사적으로 이 둘은 월 단위로 최저치를 기록했고 앞으로도 계속 그럴 것이다. 현재 켈트너 채널 200w와 바닥 사이의 간격은 꽤 크지만, 우리가 잠시 동안 옆으로 계속 간다면 그들은 다시 만날 것이다.

현재 RSI는 지켜볼 일이다. 그것은 주간지 30에 육박했던 2014년에 최저치를 찾는데 도움을 주었다.

무역

이 가정 하에서 첫 번째 기술 거래는 C 레그를 단축하는 것이다. 다양한 진입 전략이 있지만, 간단한 전략 하나만으로도 주간 헤이켄 아시 차트를 볼 수 있습니다. 톱 윅이 없는 두 개의 빨간 촛불은 그 모멘텀이 하향곡선을 그리고 있고 어떤 랠리도 53K 정도를 넘을 것 같지 않다는 것을 암시한다. 내가 아닌 조언을 할 자격이 있다면, 일상의 강도를 줄이거나 엔트리를 위한 약세 구조를 찾는 것이 바람직할 것이다. 그리고 너희들은 다음 차트에서 눈을 가늘게 뜨게 될 거야.

그 이후의 다음 거래는 긴 출품작이 될 것이다. 강세 축적자들은 이전과 같이 월 켈트너 최저 가격이나 200W를 사들이게 될 것이다. 좀 더 신중한 거래자들은 ATH에서 B파 최고조에 이르는 추세선 위에서 매주 촛불을 끄기 위한 가격 조치를 찾고 있을 것이다. 그것은 잘못된 것이다. 이것은 장기적인 계획이고 그래서 이 아이디어는 주간 거래자나 아마도 대부분의 스윙 트레이더들을 위한 것이 아니다. 나는 이것이 다시 움직이기 시작하기 전에 1년 이상 축적될 수 있기를 바란다.

원문링크: https://www.tradingview.com/chart/BLX/yQefttXa-Bitcoin-Potential-ABC-wave-based-on-MACD-and-RSI-similarities/

[본문뒤 추가문구] 서학개미 투자포럼 - 해외투자 트렌드의 중심