[선물] WTI 원유: 석유 수요는 계속 증가하고 있다. / WTI Crude Oil: oil demand continues …

선물개미

0

2440

2021.09.16 18:02

선물개미

0

2440

2021.09.16 18:02

CFDs on WTI Crude Oil

KirkBarton

Current trend

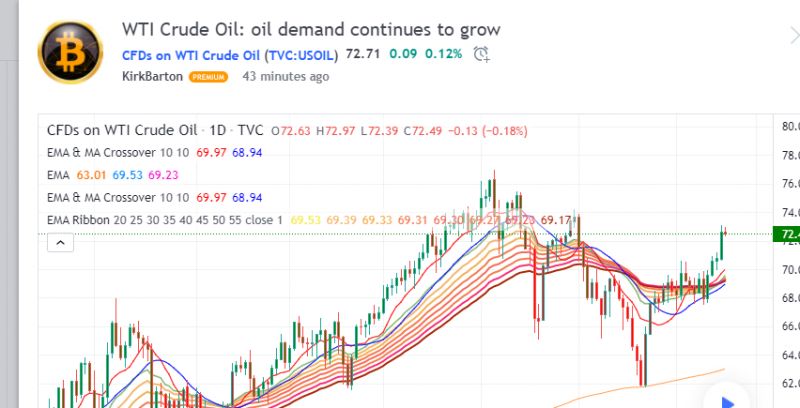

Against the backdrop of a positive report from the International Energy Agency, the price of North American light oil WTI Crude Oil is rising, trading at 72.46.

According to the ministry's renewed forecast, global energy demand in 2021 will increase by 5.2M barrels per day, which is generally in line with August data, and there is no talk of a sharp drop in demand. It is confirmed by the American Petroleum Institute ( API ) and the Energy Information Administration ( EIA ). According to API statistics, weekly stocks of "black gold" decreased by 5.437M barrels, relative to a decrease of 2.882M a week earlier. According to the EIA , the decline was even more: over the past week, the indicator lost 6.442M barrels, which is significantly higher than even the bold forecasts of analysts at 3.544M. Such dynamics mean that the oil demand continues to rise and, in some moments, exceeds the supply, which is a positive signal for the market.

Support and resistance

The price left the downwards channel on the global chart, breaking the resistance line and confidently holding above it. Technical indicators reversed and issued a sell signal: Alligator indicator's EMA fluctuations range expands towards growth, and the histogram of the AO oscillator grows in the buy zone.

Resistance levels: 73. 40 , 76.41.

Support levels: 70.50, 66.26.

Against the backdrop of a positive report from the International Energy Agency, the price of North American light oil WTI Crude Oil is rising, trading at 72.46.

According to the ministry's renewed forecast, global energy demand in 2021 will increase by 5.2M barrels per day, which is generally in line with August data, and there is no talk of a sharp drop in demand. It is confirmed by the American Petroleum Institute ( API ) and the Energy Information Administration ( EIA ). According to API statistics, weekly stocks of "black gold" decreased by 5.437M barrels, relative to a decrease of 2.882M a week earlier. According to the EIA , the decline was even more: over the past week, the indicator lost 6.442M barrels, which is significantly higher than even the bold forecasts of analysts at 3.544M. Such dynamics mean that the oil demand continues to rise and, in some moments, exceeds the supply, which is a positive signal for the market.

Support and resistance

The price left the downwards channel on the global chart, breaking the resistance line and confidently holding above it. Technical indicators reversed and issued a sell signal: Alligator indicator's EMA fluctuations range expands towards growth, and the histogram of the AO oscillator grows in the buy zone.

Resistance levels: 73. 40 , 76.41.

Support levels: 70.50, 66.26.

번역:

WTI 원유에 대한 CFD

커크바튼

현재 추세

국제에너지기구(IEA)의 호재가 나오면서 북미산 경유 WTI 원유 가격이 72.46에 거래되고 있다.

지경부의 새로운 전망에 따르면 2021년 세계 에너지 수요는 8월 자료에 대체로 부합하는 하루 5.2만 배럴 증가할 것이며, 수요 급감 이야기는 없다. 이는 미국석유협회(API)와 에너지정보국(EIA)에 의해 확인됩니다. API 통계에 따르면, "블랙골드" 주간 주식은 전주 2.882만 배럴 감소에 비해 543만 배럴 감소했다. EIA에 따르면, 하락폭은 훨씬 더 컸다: 지난 주 동안, 이 지표는 분석가들의 대담한 전망인 3.544만 배럴보다 훨씬 높은 6.44만 배럴을 잃었다. 이러한 역학관계는 석유 수요가 계속 증가하고 있고, 어떤 순간에는 공급을 초과한다는 것을 의미하며, 이는 시장에 긍정적인 신호이다.

지지와 저항

가격은 글로벌 차트의 아래쪽 채널을 떠나 저항선을 깨고 자신 있게 그 위에 머물렀다. 기술 지표가 역전되어 판매 신호를 보냈습니다. 악어 지표의 EMA 변동 범위는 성장을 향해 확장되고 AO 발진기의 히스토그램은 구매 영역에서 증가합니다.

저항 수준: 73. 40, 76.41

지원 레벨: 70.50, 66.26.

원문링크: https://www.tradingview.com/chart/USOIL/31DhlBqX-WTI-Crude-Oil-oil-demand-continues-to-grow/

[본문뒤 추가문구] 서학개미 투자포럼 - 해외투자 트렌드의 중심