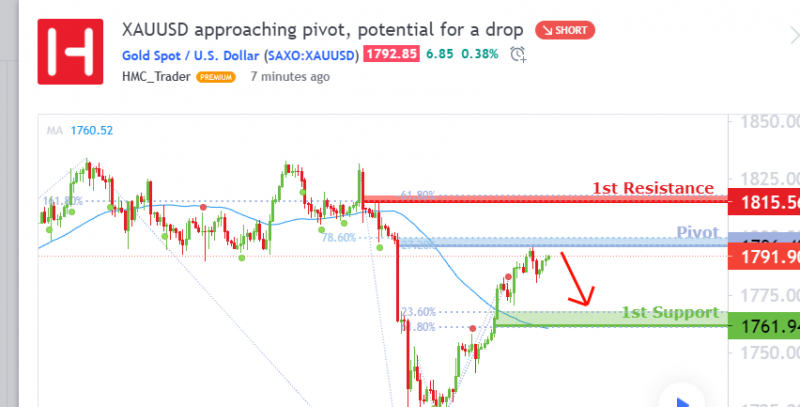

[선물] XAUUSD가 피벗에 접근 중이고, 떨어질 가능성이 있음 / XAUUSD approaching pivot, poten…

선물개미

0

1683

2021.08.18 15:42

선물개미

0

1683

2021.08.18 15:42

Gold Spot / U.S. Dollar

HMC_Trader

Price is approaching our pivot level at 1,796.49 which is in line with -27.2% Fibonacci retracement level and 78.6% Fibonacci extension level and horizontal overlap resistance. Price could potentially drop towards support at 1,761.94, in line with 23.6% Fibonacci retracement level , 61.8% Fibonacci extension level and 50MA. Stochastic is also at resistance level where previous drops occurred.

Alternatively, price may bounces to our resistance at 1,815.56, which coincides with -61.8% Fibonacci retracement level and 161.8% Fibonacci extension level.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

Alternatively, price may bounces to our resistance at 1,815.56, which coincides with -61.8% Fibonacci retracement level and 161.8% Fibonacci extension level.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

번역:

골드 스폿/미국 달러

HMC_Trader

가격은 -27.2%의 피보나치레터링 레벨과 78.6%의 피보나치 연장 레벨 및 수평 오버랩 저항력과 일치하는 1,796.49의 피벗 레벨에 근접하고 있습니다. 가격은 잠재적으로 피보나치 회수율 23.6%, 피보나치 연장율 61.8%, 50MA에 맞춰 1,761.94로 하락할 수 있습니다. 확률학도 이전 낙하가 발생한 저항 수준이다.

또는, 가격은 -61.8%의 피보나치 퇴적 수준 및 161.8%의 피보나치 확장 수준과 일치하는 1,815.56의 저항으로 반등할 수 있습니다.

본 웹 사이트에 포함된 모든 의견, 뉴스, 연구, 분석, 가격, 기타 정보 또는 제3자 사이트에 대한 링크는 "있는 그대로" 제공되며 일반적인 시장 논평으로 구성되지는 않습니다. 시장해설은 투자연구의 독립성을 촉진하기 위해 마련된 법적 요구사항에 따라 작성되지 않았으므로 보급 전 거래에 대한 어떠한 금지도 받지 않는다. 비록 이 논평을 독립적인 출처에 의해 작성되지는 않지만, FXCM은 이 통신의 생산과 보급에서 발생하는 이해충돌을 제거하거나 방지하기 위해 모든 충분한 조치를 취한다. FXCM의 종업원은 고객의 최선의 이익을 위해 행동할 것을 약속하며 고객이 정보에 입각한 투자 결정을 내릴 수 있는 능력을 오해하거나 기만하거나 손상시키지 않고 자신의 견해를 표현합니다. 충돌 방지를 위한 FXCM의 내부 조직 및 관리 준비에 대한 자세한 내용은 회사의 충돌 관리 정책을 참조하십시오. 웹 사이트에서 액세스할 수 있는 이전 정보에 대한 당사의 전체 면책 조항 및 책임 조항을 읽고 이해하십시오.

원문링크: https://www.tradingview.com/chart/XAUUSD/hAv6npIW-XAUUSD-approaching-pivot-potential-for-a-drop/

[본문뒤 추가문구] 서학개미 투자포럼 - 해외투자 트렌드의 중심