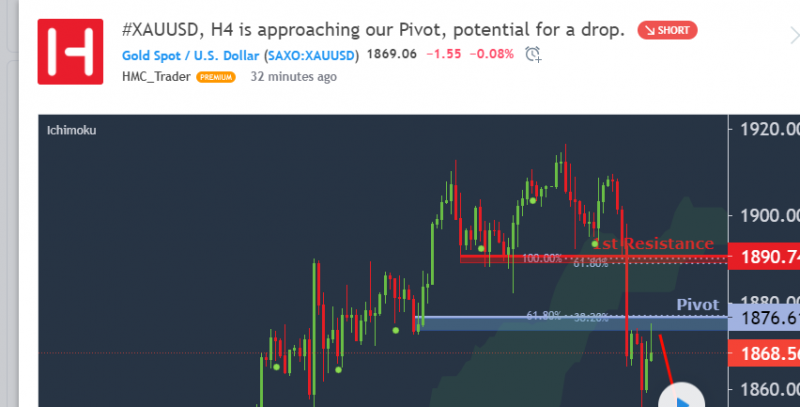

[선물] #XAUUSD, H4가 피벗에 접근하고 있습니다. 떨어질 가능성이 있습니다. / #XAUUSD, H4 is appro…

선물개미

0

2141

2021.06.04 17:59

선물개미

0

2141

2021.06.04 17:59

Gold Spot / U.S. Dollar

HMC_Trader

Description

Price is testing our Pivot point at 1876.61, which is in line with 38.2% fibonacci retracement , 61.8% fibonacci extension and horizontal graphical overlap. We could potentially see a drop from our Pivot point towards our 1st support level at 1845.44, which is in line with 161.8% fibonacci retracement , 61.8% fibonacci extension and horizontal graphical overlap. It's worth noting that price is under the Ichimoku cloud , in line with our bearish analysis.

Pivot: 1876.61

Why we like it:

38.2% fibonacci retracement , 61.8% fibonacci extension and horizontal graphical overlap

1st Support: 1845.44

Why we like it:

161.8% fibonacci retracement , 61.8% fibonacci extension and horizontal graphical overlap

1st Resistance: 1890.74

Why we like it:

61.8% fibonacci retracement , 100% fibonacci extension and horizontal graphical overlap.

Trading FX & CFDs carries high risk.

Price is testing our Pivot point at 1876.61, which is in line with 38.2% fibonacci retracement , 61.8% fibonacci extension and horizontal graphical overlap. We could potentially see a drop from our Pivot point towards our 1st support level at 1845.44, which is in line with 161.8% fibonacci retracement , 61.8% fibonacci extension and horizontal graphical overlap. It's worth noting that price is under the Ichimoku cloud , in line with our bearish analysis.

Pivot: 1876.61

Why we like it:

38.2% fibonacci retracement , 61.8% fibonacci extension and horizontal graphical overlap

1st Support: 1845.44

Why we like it:

161.8% fibonacci retracement , 61.8% fibonacci extension and horizontal graphical overlap

1st Resistance: 1890.74

Why we like it:

61.8% fibonacci retracement , 100% fibonacci extension and horizontal graphical overlap.

Trading FX & CFDs carries high risk.

번역:

골드 스폿/미국 달러

HMC_트레이더

설명

가격은 피벗 포인트를 1876.61로 테스트하고 있습니다. 피벗 포인트는 38.2% 피보나치 재추적, 61.8% 피보나치 확장 및 수평 그래픽 겹침과 일치합니다. 피벗 포인트에서 1845.44의 첫 번째 지원 레벨로 떨어지는 것을 볼 수 있으며, 이는 161.8% 피보나치 재추적, 61.8% 피보나치 확장 및 수평 그래픽 오버랩과 일치한다. 가격이 이치모쿠 클라우드 아래 있다는 것은 우리의 약세 분석과 일치합니다.

피벗: 1876.61

우리가 좋아하는 이유:

38.2% 피보나치 재추적, 61.8% 피보나치 확장 및 수평 그래픽 겹침

첫 번째 지원: 1845.44

우리가 좋아하는 이유:

161.8% 피보나치 재추적, 61.8% 피보나치 확장 및 수평 그래픽 겹침

1차 저항: 1890.74

우리가 좋아하는 이유:

61.8% 피보나치 재추적, 100% 피보나치 확장 및 수평 그래픽 겹침.

FX와 CFD를 거래하는 것은 높은 위험을 수반한다.

원문링크: https://www.tradingview.com/chart/XAUUSD/DZoyMUfW-XAUUSD-H4-is-approaching-our-Pivot-potential-for-a-drop/

[본문뒤 추가문구] 서학개미 투자포럼 - 해외투자 트렌드의 중심